'Cupcakes saved me'

How one author merged baking, storytelling and money in search of 'emotional literacy' and what you can learn from her work

Hi, my friend.

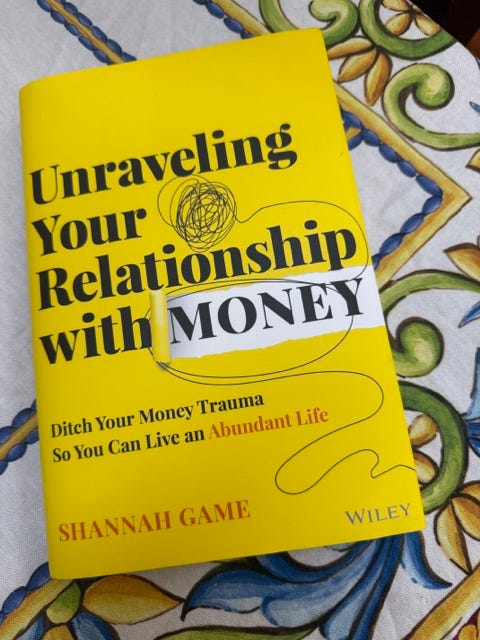

Meet Shannah Game. She’s a certified financial planner, an author of an amazing new book called “Unraveling Your Relationship with Money: Ditch Your Money Trauma So You Can Live an Abundant Life,” a former podcaster with millions of downloads to her credit, a new Substacker, and a baker with a passion for cupcakes!

But beyond all that, she’s a friend of mine. I’ve been lucky to know her for many years, thanks to our mutual interest in personal finance. So I was thrilled when she agreed to share her wisdom with us here at “Ask, Save, Earn.”

In our wide-ranging interview, we discuss the importance of addressing the emotions associated with money before tackling the numbers, how she estimates that she has saved tens of thousands of dollars over the years “just by picking up the phone,” and how cupcakes saved her.

You’ll even find her secrets to making the perfect cupcake.

Enjoy!

MS: Tell me a little about yourself and your Substack.

SG: I’m a Certified Financial Planner and trauma-of-money specialist who’s spent over 20 years helping people heal their relationship with money. But these days, my work isn’t just about spreadsheets and savings goals — it’s about the stuff underneath: identity, shame, reinvention, midlife shifts, the quiet panic that no one else seems to be talking about.

My Substack is simply called Shannah Game. It’s a space where I explore money, midlife, and all the things people are usually too shy to bring up — the emotional hangovers after spending, the grief that shows up in your bank account, the way money ties into self-worth and aging. It’s equal parts confessional and curious.

In some weeks, I write about what’s happening in my wallet; in other weeks, it’s what’s happening in my head. My goal is to normalize the conversations that happen in whispers — because money isn’t just math, it is meaning.

MS: When I interviewed you for my book, you told me that you regularly called companies and asked them for discounts and better deals. Over the years of doing that, what have you learned that can help people have the same success you’ve had? Are there certain steps you take when making these requests?

SG: I’ve probably saved tens of thousands of dollars just by picking up the phone — which is funny, because most people would rather do anything than ask for a deal. What I’ve learned is that asking is a money muscle. The more you use it, the stronger it gets.

I always start from the mindset that it’s a conversation, not a confrontation. I’ll say something like, “Hey, I’ve been a loyal customer for a while. Is there any way to lower my rate or add a discount?” That’s it. You’d be amazed at how often they say yes.

A few steps that make a big difference:

Be friendly but direct. People mirror your energy — lead with warmth.

Have some facts ready. Know what competitors are offering.

Don’t rush the silence. The pause after you ask is powerful. Let it sit.

Say thank you, even if the answer’s no. It leaves the door open for later.

The bigger lesson? Asking for what you want — whether it’s a discount, a raise, or just clarity — rewires something deeper. It teaches you that your voice has value.

MS: You have an amazing book called “Unraveling Your Relationship With Money.” So many people have such a complex relationship with money, and it is often rooted in shame, fear and helplessness. For someone wrestling with those and other feelings related to money, what first steps can they take to begin the healing process?

SG: The first step is to stop trying to fix your money story like it’s broken. It’s not broken — it’s just unhealed. That’s why in my book I talk about my signature process of Heal, Plan, Build. Most people just want to dive into the build phase and wonder why things aren’t working. It’s because healing is probably the most important step.

When people feel shame or fear around money, they usually go straight to punishment: “I’ve got to budget harder. I’ve got to stop spending.” But you can’t out-math your emotions. You have to start by listening to them.

Here’s what I recommend:

Name what you feel. Is it guilt? Fear? Panic? Say it out loud or write it down.

Trace it back. Ask: “Where did I first learn to feel this way about money?” You’ll almost always find a story from childhood, a moment when you absorbed someone else’s beliefs.

Meet yourself with compassion. You’re not bad with money — you’re reacting to old wiring.

Once you start to see money as emotional data, not a moral report card, everything starts to shift.

MS: Are you someone who has struggled with their relationship with money over the years?

SG: Oh, absolutely. I’ve lived through multiple money rock bottoms, even as a financial expert. There were times I had all the external success but was still haunted by this internal voice saying, “You should be further along.”

My money work is deeply personal. I grew up around both wealth and financial chaos, so I learned early that money could mean safety one day and loss the next. It made me a perfectionist about finances — and at the same time, terrified of not getting it right.

Over time, I realized I wasn’t chasing financial security, I was chasing emotional security. The work I do now — whether it’s in my book, my writing, or coaching — is really about helping other people find that same peace.

MS: In doing your book, podcast and Substack over the years, is there any one piece of money advice that you think is underrated or just not talked about enough?

SG: Yes. That your emotional literacy is more important than your financial literacy.

You can read every investing book and still overspend when you’re anxious, or freeze when it’s time to make a big decision. The real work is learning to recognize what’s happening inside you before you take action with money.

Another underrated truth: Money healing isn’t linear. You don’t “arrive.” You revisit. You learn, you unlearn, and you try again. That’s why I tell people: treat your money journey like therapy, not like a checklist.

MS: Finally, let’s talk cupcakes. I know you’re passionate about baking and food. What is it about cupcakes, in particular, that you love so much? And for aspiring bakers out there, what’s the key to baking a perfect cupcake that’ll taste like you bought it from the best bakery in town?

SG: Cupcakes saved me. Honestly. I started baking during one of the hardest seasons of my life. I was overwhelmed, exhausted, and needed something small I could actually finish. Cupcakes became this tiny form of proof that good things can still rise, even when everything else feels flat.

What I love most is their joy-to-effort ratio. You don’t need perfection, just intention. Cupcakes have a lot in common with money -- they are both emotional.

My cupcake secrets?

Always use room-temperature butter and eggs. That’s what gives you that bakery texture.

Don’t overmix. Stop when the batter just comes together.

Bake at 325°F for a few extra minutes. It helps them stay soft and rise evenly.

Finally, bake for someone you love, even if it’s yourself. That’s the real secret ingredient. (BTW, I bake gluten-free, and the BEST flour is King Arthur 1:1 flour.)

MS: I love that you’re merging baking, storytelling, and money. How do those worlds connect for you?

SG: They’re all about transformation. Whether you’re healing your finances or baking cupcakes, it’s about taking raw, messy ingredients and creating something beautiful. The process is emotional, imperfect, and deeply human — just like money.

How’s your relationship with money?

It’s one of the most challenging relationships anyone can have. Like many people, I’ve had a love/hate relationship with money over the years. I feel incredibly fortunate to be on the “love” side of things today, but I know it hasn’t always been that way.

How are you feeling about? Vote in the poll, and then share your thoughts below.

Until next time!

Matt

I answered no to the poll - but slowly working working on healing as Shannah so perfectly says through education, use of budgeting, and paying off what we consider stressful debt (we're okay with our mortgage).